Tax season is around the corner once again, and it is important to be prepared when it is time to file. By preparing preemptively, you will be in a much better position once you file. Here are some steps for you to take now in order to get ready.

Decide Whether or Not To Adjust Tax Withholding

The odds are pretty good that you work for your employer, and if you do, the government takes their cut of your earnings from your paycheck. However, the amount depends on not only how much you earn, but how many tax allowances that you’ve claimed. If you claim more allowances, the government will take less from each of your paycheck. Single adults on average will claim around one to two allowances, whereas working parents will claim more.

The more allowances you claim, your paychecks will be larger. However, your refund check could be smaller as a result. This is because the amount you pay in the year will be closer to your tax liability. Do not claim more allowances than you should. A good indicator is to look at your 2018 tax refund check. If it was only around several thousand dollars, that could be a sign that you are not claiming enough allowances as you should. You can change this by submitting a new W-4 form to your employer.

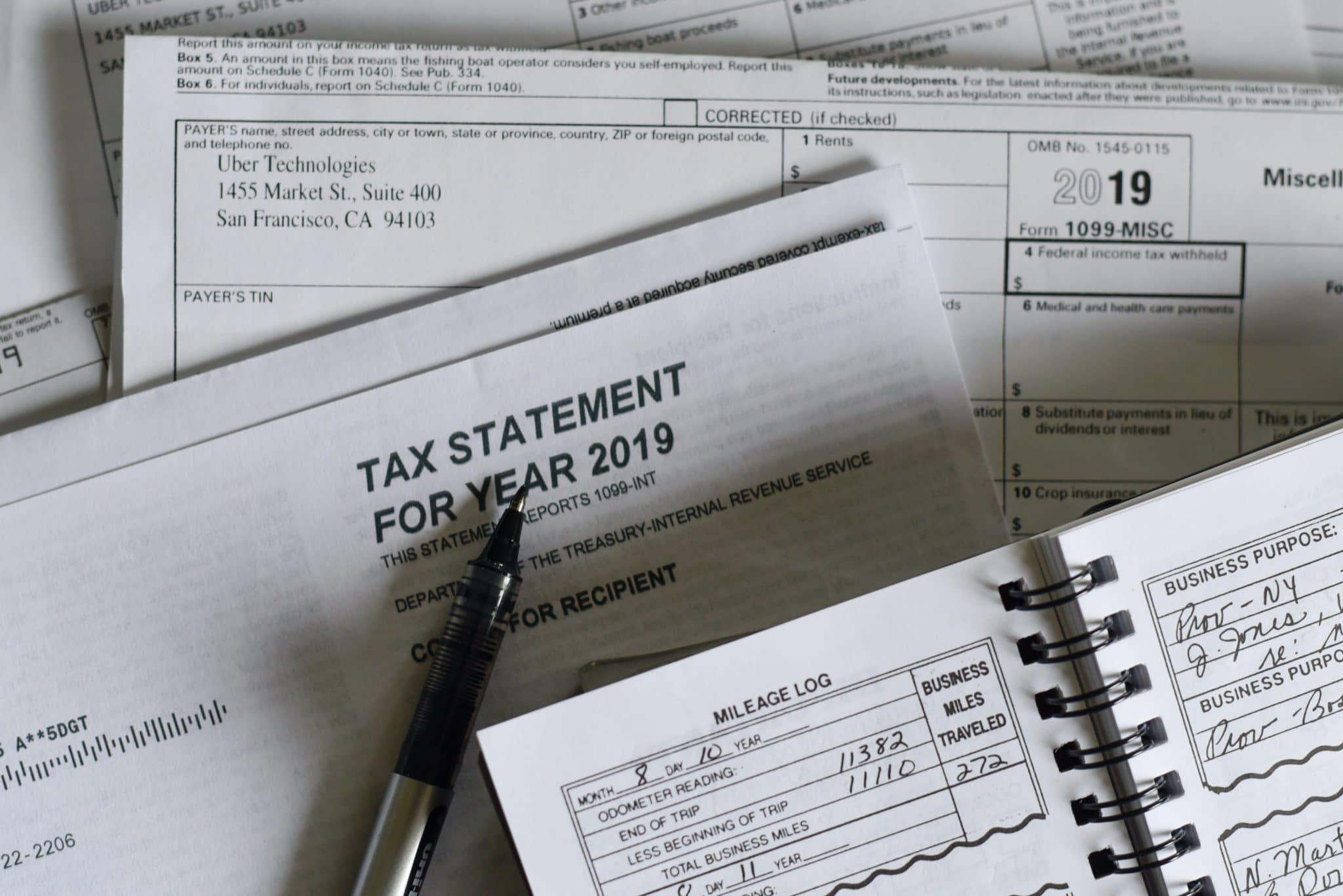

Keep Track of Deductible Expenses

This tip applies more to self-employed individuals. Deductions in travel, office expenses and other business-related expenditures may need to be considered on taxes. However, there are other deductions that anyone can qualify for, such as medical expenses or charitable contributions.

The only catch around this is that you can only claim these deductions provided you have paper documentation of such. These deductions does not have to be submitted with your taxes, but it has to be presented if you get audited. A folder containing all of your receipts and paperwork related to your tax deductions should be available so that you can have them in one place. You need to devise a way where you also have digital copies on your computer and back them up so that you do not lose them. This can also prevent unnecessary clutter in your home.

Familiarize Yourself With Tax Law Changes

This is arguably the most important tip, as it can affect what you file and how you file each year. Every year, the government makes subtle, but important changes with the tax laws. Tax brackets shift slightly often, and along with this, so do the qualifications that are necessary for some tax credits and deductions.

While you do not have to familiarize yourself with every single rule to the letter, you should be familiar with key changes that will affect you in the upcoming year.For more information on important financial information that you need to prepare yourself for, you can visit Rusty Tweed for more info.

Filing taxes is never enjoyable, no matter how you put it. However, with enough planning, tax season will be significantly less stressful. Take these steps today, and you won’t be met with any unpleasant surprises by the government was tax season in 2020 arrives

0 Comments