Section 1 – Ian Leaf Tax – Tips and Tricks

Income tax organizing is highly influenced by exactly where your house is, however you can find typical tactics that affect income tax systems within a lot of international locations. You should verify along with the income tax code which applies to you – there could end up being more than a single. The way of thinking encircling income taxes happens to be essential in understanding just what the inspiration powering a tax happens to be. The particular continuous tariff of making money – that is precisely how you must treat taxes. These ought to at all times end up being taken into account prior to making an investment, accepting job or perhaps building a business. It’s not just what you make within income which makes a difference, it’s exactly what you obtain to keep net regarding pretty much all bills – and this consists of taxes(1, 2, 3, 4). The moment you actually determine this, you know exactly what to expect from the income tax scenario and if it is really worth starting a specific thing. And the identical theory refers to doing work anywhere – you have to bear in mind precisely how much money you come up with after the particular income taxes day-to-day. The particular job together with by far the most cash flow after taxes is what requires to end up being selected if you happen to be picking from numerous possibilities.

Nevertheless there exists a single thing we need to talk about and it’s regarded as tax fraudulence. Sure, there are numerous folks who pay out their particular income taxes when needed. Yet the particular reality happens to be that you will find furthermore plenty of individuals who aren’t declaring all of the profits and happen to be cheating the particular system. We can solely speculate exactly how typical the tax scam is because most folks do not get busted. It is an easy task to make tax fraudulence and that’s precisely why it is a huge dilemma. Anybody may keep info coming from the Income and have a rather great likelihood associated with proceeding unseen. Numerous individuals (and corporations) go ahead and take risk considering that they don’t want to give away their funds. -Excerpt from Ian Leaf Tax Tips, Tricks, Advice and Thoughts from a 20 Year Veteran.

And if perhaps you are actually serious about finding fraud well then Ian Leaf Tax is without question a little something helpful. Discovering fraudulence happens to be very hard. The thing happens to be that individuals realize precisely what they’re undertaking and do not come up with ridiculous mistakes. It happens to be for that reason that vigilance happens to be necessary on the actual portion of potential victims associated with fraud, especially business owners, insurance firms and also banks. It’s essential to point out the fact that fraudulence could take place in any sort of situation. And Ian Leaf combined with Ian Andrews is what is well worth looking at.

All of us realize that tax planning is definitely something that is determined by the actual country you are in nevertheless you will find several general techniques that affect all the nations around the world. Please verify with the income tax code that relates to you – there might end up being far more than a single. Have you actually at any time wondered just what is the mindset regarding the particular taxes? If that’s the case, then first you actually require to realize the actual motivation in income taxes. The very first matter you actually require to realize is precisely how to deal with income taxes. They must be treated as being an ongoing tariff of making profits. You actually require to account the particular taxes prior to beginning a business or perhaps generating a trade of some sort. A great deal of folks simply take a look at earnings and certainly not into the particular quantity of money these people earn after all the particular income taxes and it is a tremendous problem. By taking that under consideration you’ll always realize if perhaps it is advantageous for you personally to start carrying out something or perhaps not. Going to work needs to in addition end up being seen in this way. Pay attention to precisely how much money you get to continue to keep following income taxes. In case it comes to choosing out of several careers, you should select the particular one with by far the most revenue right after income taxes.

precisely how to deal with income taxes. They must be treated as being an ongoing tariff of making profits. You actually require to account the particular taxes prior to beginning a business or perhaps generating a trade of some sort. A great deal of folks simply take a look at earnings and certainly not into the particular quantity of money these people earn after all the particular income taxes and it is a tremendous problem. By taking that under consideration you’ll always realize if perhaps it is advantageous for you personally to start carrying out something or perhaps not. Going to work needs to in addition end up being seen in this way. Pay attention to precisely how much money you get to continue to keep following income taxes. In case it comes to choosing out of several careers, you should select the particular one with by far the most revenue right after income taxes.

But there’s a single thing we have to focus on and it is acknowledged as being tax fraud. The actual amount of persons which gamble with the particular tax and also under-declare their revenue is certainly massive and the actual people who are paying all the income taxes happen to be suffering due to this. It is in fact out of the question to realize the true spread regarding the tax scam. It is actually an easy task to make tax scam and this is the reason why it is an enormous issue. Any person can withhold information from the Revenue and have a relatively good chance regarding proceeding unnoticed. To be able to keep all of their self employed pay many folks will certainly consider the danger and attempt to keep off the tax authority records fully.

Concerns from a Happier Time With Mr. Leaf

Mortgage rates currently (will change daily). Please verify before proceeding.

Tax organizing happens to be somewhat different within every single region. Yet you will find certain basic strategies which apply to income tax planning within almost all international locations. You need to always check with the particular taxation code that is in your current country. Have you actually ever pondered the taxes in NH just what happens to be the particular state of mind associated with the taxes? If so, then initially you need to comprehend the actual inspiration in taxes. The very first matter you actually require to understand is exactly how to deal with income taxes. These should be treated as being an ongoing tariff of making profits. You actually require to account the taxes before starting a company or producing an investment associated with some kind. The actual thing that makes a difference is exactly what you get to keep right after all the actual bills – not precisely what you earn within revenue. As soon as you determine this, you actually know just what to anticipate coming from your tax scenario and if perhaps it happens to be well worth starting a specific thing. And exactly the same basic principle pertains to doing work anywhere – you must take into account exactly how much funds you generate after the income taxes daily. The actual job with essentially the most cash flow after taxes is exactly what requires to be picked in case you’re selecting from several selections.

Yet the particular real thing all of us would like to talk about within this article is recognized as being tax fraud. With regard to every single person that pays off his / her tax as well as business that reports the earnings specifically, there has to be someone which under-declares their particular income or perhaps business which conceals its results out of the actual tax man. It’s actually impossible to recognize the true spread associated with the actual tax scam. The reason exactly why tax scam is so typical and is actually an enormous dilemma these days is the fact that it happens to be truly simple to commit. Any individual may withhold information coming from the particular Income and stand a reasonably excellent chance associated with going undetected. In order to keep all of their self-employed pay a lot of individuals will consider the danger and attempt to stay off the tax authority records entirely.

And if you’re actually enthusiastic about discovering fraud then Ian Leaf fraud warnings is certainly a little something helpful. Discovering fraudulence is extremely challenging. In the end, an action of fraudulence is without question an action associated with intentional deceptiveness, and the actual goal associated with this specific behave happens to be to maintain the target or even victims from knowing they have already been defrauded. And that’s exactly why vigilance happens to be a specific thing that cannot be ignored. It’s crucial to point out the fact that fraudulence could occur in any kind of circumstance. And Ian Andrews is the particular individual which happens to be strongly related to Ian Leaf in case you actually would like to find out more.

Income tax organizing is somewhat different within each and every country. But you will discover some basic techniques that connect with taxation planning here, here, here, and here within pretty much all nations around the world. The particular taxation code regarding your nation is certainly a little something that demands to be checked. Have you actually ever wondered exactly what happens to be the particular frame of mind regarding the particular taxes? If yes, as Ian Leaf fraudster stopper suggests, in that case initially you actually need to comprehend the inspiration in taxes. The 1st matter you require to realize happens to be just how to deal with taxes. They must be treated as being a continuous price of earning profits. You need to account the income taxes ahead of commencing a small business or producing a trade regarding some sort. It’s not precisely what you make within income which is important, it’s just what you receive to keep net associated with pretty much all expenditures – and this consists of taxes. Once you actually determine that, you realize exactly what to expect from the income tax situation and if it is well worth starting something. And precisely the same theory refers to working anyplace – you must consider how much funds you generate right after the particular taxes daily. In the event that it comes to choosing out of multiple work opportunities, you ought to select the actual one together with by far the most income following income taxes.

Income tax organizing is somewhat different within each and every country. But you will discover some basic techniques that connect with taxation planning here, here, here, and here within pretty much all nations around the world. The particular taxation code regarding your nation is certainly a little something that demands to be checked. Have you actually ever wondered exactly what happens to be the particular frame of mind regarding the particular taxes? If yes, as Ian Leaf fraudster stopper suggests, in that case initially you actually need to comprehend the inspiration in taxes. The 1st matter you require to realize happens to be just how to deal with taxes. They must be treated as being a continuous price of earning profits. You need to account the income taxes ahead of commencing a small business or producing a trade regarding some sort. It’s not precisely what you make within income which is important, it’s just what you receive to keep net associated with pretty much all expenditures – and this consists of taxes. Once you actually determine that, you realize exactly what to expect from the income tax situation and if it is well worth starting something. And precisely the same theory refers to working anyplace – you must consider how much funds you generate right after the particular taxes daily. In the event that it comes to choosing out of multiple work opportunities, you ought to select the actual one together with by far the most income following income taxes.

Nevertheless the particular real matter we wish to discuss within this particular article is regarded as tax scam. Regarding each and every person who pays his / her tax and business which reports the profits precisely, there must be someone who under-declares their own earnings or even company that covers its success out of the actual tax man. It is actually unattainable to know the true spread regarding the tax fraud. It’s easy to make tax scam and that’s precisely why it is an enormous difficulty. Anybody could hold back information from the Revenue and have a rather good likelihood regarding going unseen.

Nevertheless the particular real matter we wish to discuss within this particular article is regarded as tax scam. Regarding each and every person who pays his / her tax and business which reports the profits precisely, there must be someone who under-declares their own earnings or even company that covers its success out of the actual tax man. It is actually unattainable to know the true spread regarding the tax fraud. It’s easy to make tax scam and that’s precisely why it is an enormous difficulty. Anybody could hold back information from the Revenue and have a rather good likelihood regarding going unseen.

And if you happen to be in fact serious about revealing fraudulence in that case Ian Leaf Tax is actually a little something beneficial. It’s not at all shocking that in terms of recognition regarding fraudulence – it happens to be a hard action to take. Many individuals do not make mistakes that happen to be simple to identify in terms of tax fraudulence. And this explains obviously the reason why caution happens to be absolutely essential in fact. Even though there happen to be certainly sectors that are far more vulnerable to deceitful behavior compared to others, it is actually nevertheless essential to understand that acts associated with fraud occur within any quantity of circumstances and are often dedicated by the particular unlikeliest associated with perpetrators. And in terms of learning a lot more, Ian Andrews is the person you should look for.

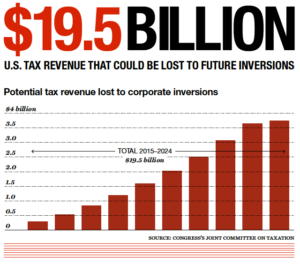

2/19/2016 10:22 AM PST: This post has been updated to reflect current tax rates, Walmart tax avoidance graphic, Ian Leaf tax return data and fraud examples.

This post should not be construed or used as tax advice. Please consult a tax professional to verify any and all information.

30 Comments

Al Amin · February 20, 2016 at 2:00 am

This page is very informative page.That gives us most vital information.

arup biswas · February 20, 2016 at 3:56 am

This is great article. Very important for me. Thanks

abdullah al azad · February 20, 2016 at 3:59 am

Most useful news here. Everybody should knows about this. Thanks for share this important post .

anik rashed · February 19, 2016 at 8:01 pm

Really a nice article that contains many important information about Ian Leaf Tax. People can learn many things from this article. Thanks for this article.

Foysal Hasan · February 19, 2016 at 8:05 pm

This article has provided very good information about the Ian Leaf Tax tricks. I think this will be very helpful for us. Thanks for sharing.

Mahabub Alam · February 19, 2016 at 8:08 pm

Really nice article about Leaf tax. here Risk Takers part is very important. Thanks for nice article.

MD Shafiul Alom · February 19, 2016 at 8:08 pm

Wow this is a nice Ian Leaf Tax – Tips.I like this Ian Leaf Tax – Tips.Thanks for shear on this Ian Leaf Tax – Tips.Everybody should knows about this.

gour singh · February 19, 2016 at 8:08 pm

I am Very happy to find this informative article for me and truly get useful information from this page. So, thanks to admin to share this article with us.

toufik · February 19, 2016 at 9:10 pm

I am Very glad to locate this enlightening article for me and genuinely get helpful data from this page.The specific employment together with by a long shot the most income after duties is the thing that requires to wind up being chosen in the event that you happen to be picking from various potential outcomes.

Akash Ahmed · February 19, 2016 at 9:10 pm

Very nice tips that I needed. It is written with important information and clearly described about Ian Leaf Tax . Thanks to the writer for this unique article.

Abdullah Masum · February 19, 2016 at 9:12 pm

This page provides a good information about Ian Leaf Tax – Tips and Tricks.It gives me more knowledge about that topics.So Thanks admin to share this article with us.

NVTMR · February 19, 2016 at 9:12 pm

After reading this article, now i know little about managing incoming tax and be carefully about fraudulance. Thank you very much for this good information. I will share to all of my friends, they must be know it.

mahfuz · February 19, 2016 at 9:12 pm

Wow this is a nice Ian Leaf Tax – Tips.I like this Ian Leaf Tax – Tips.Thanks for sharing on this Ian Leaf Tax – Tips.Everybody should knows about this.

Afroza khan · February 19, 2016 at 9:14 pm

Really a nice article that contains many important information about Ian Leaf Tax. People can learn many things from this article. Anybody could hold back information from the Revenue and have a rather good likelihood regarding going unseen. Thanks for the article.

abdullah al ahad · February 19, 2016 at 9:15 pm

Ian Leaf Tax is most important to know all kinds of people.For awareness all kind of people must be know about Ian Leaf Tax and paid tax carefully.This page is most helpful and to much important news here.Thanks for share this important news.

Nitay · February 19, 2016 at 9:15 pm

Long time after I find a real article for Ian Leaf Tax. Really it is a nice article that contains, I find here many important information about Ian Leaf Tax. People can learn many things from this article. Thanks a lot for this article writer.

Ruhul Amin · February 19, 2016 at 9:16 pm

Really nice article about Leaf tax.I am very important informative article for us.thanks to admin to share this article with us.

Sumi · February 19, 2016 at 9:17 pm

this post is very important for know about Ian Leaf Tax. Read this post and know more.

Alina · February 19, 2016 at 9:19 pm

wow really amazing article. it was really useful . By this article anyone can easily know about Ian Leaf Tax. Thanks for sharing this with us. Waiting for next article.

mamun · February 19, 2016 at 9:19 pm

this page is very informative page. All the information are very useful in this page. All the article are very important in this page. I want to give thank you the admin for this excellent page and article

Moklesar mahamud · February 19, 2016 at 9:19 pm

Very informative article man. Ian Leaf Tax part is very interesting and other part like Risk Takers is very essential. By reading this article anyone have get great idea about Leaf tax. Thanks for this nice and essential article.

Lijon · February 19, 2016 at 9:19 pm

Wow. Thanks to the admin for such this information. Truly speaking it is really important for all the people. I am benefited. I shared to my facebook wall.

Ritu · February 19, 2016 at 9:19 pm

Anyone can easily know about Ifan Leaf Tax. People can learn many things from this article. Thaks for this amazing post.

mure · February 19, 2016 at 9:21 pm

I am Very happy to find this informative article for me and truly get useful information from this page,., Thanks for nice article.

Rashed khan · February 19, 2016 at 9:22 pm

I think this post is very important and informative post about Ian Leaf Tax. This article will help people because it contains a lot of necessary information about Ian Leaf Tax. So thanks for this nice post.

Farhad · February 19, 2016 at 9:22 pm

It’s really nice article for me… I hope that its very great full to all of us. Make sure that it’s provide to a writing an expert article. so that the article if that find this imformative article for me. So really nice article about Leaf tax.

Mrina · February 19, 2016 at 9:23 pm

Really very nice article provided for the Ian Leaf Tax user. Actually we find here Most useful news . Everybody should knows about this article easily. Thanks for share this important post and welcome to the article maker.

Nasir · February 19, 2016 at 9:25 pm

I am Very happy to find this informative article for me and truly get useful information from this page. So, thanks to admin to share this article with us.

Md.Jewel Rana · February 19, 2016 at 9:27 pm

This article has provided very good information about the Ian Leaf Tax tricks.It is very important for me.Thanks for shear on this article and thanks to admin.

Syem · February 19, 2016 at 9:31 pm

Really nice article about Leaf tax. here Risk Takers part is very important.This article has provided very good information about the Ian Leaf Tax tricks. I think this will be very helpful for us.Thanks for nice article.