“Over the course of the last decade, the markets for cryptocurrencies have been rapidly evolving and are becoming a lot more standardized.” This statement from Saleh Stevens is the reality of virtual currencies such as Bitcoin, that are subject to taxation by the IRS. Unfortunately, many are still unaware of the looming crisis of evading taxes. Here are X things to know about the cryptocurrencies and taxes.

1. The IRS and Cryptocurrencies

According to a recent study by Credit Karma , less than 100 people of the 25000 that have filed taxes through the company have reported any taxable event to the IRS. 57% of the 2000 participants of the survey stated that they had realized gains from cryptocurrencies, with roughly the same percentage disclosing that they had never reported gains to the IRS. Surprisingly, more than half of the participants were aware of the impact of cryptocurrencies on their taxes. It is not surprising that the IRS sued Coinbase for access to customer records in 2017. It is only a matter of time before more evaders get caught.

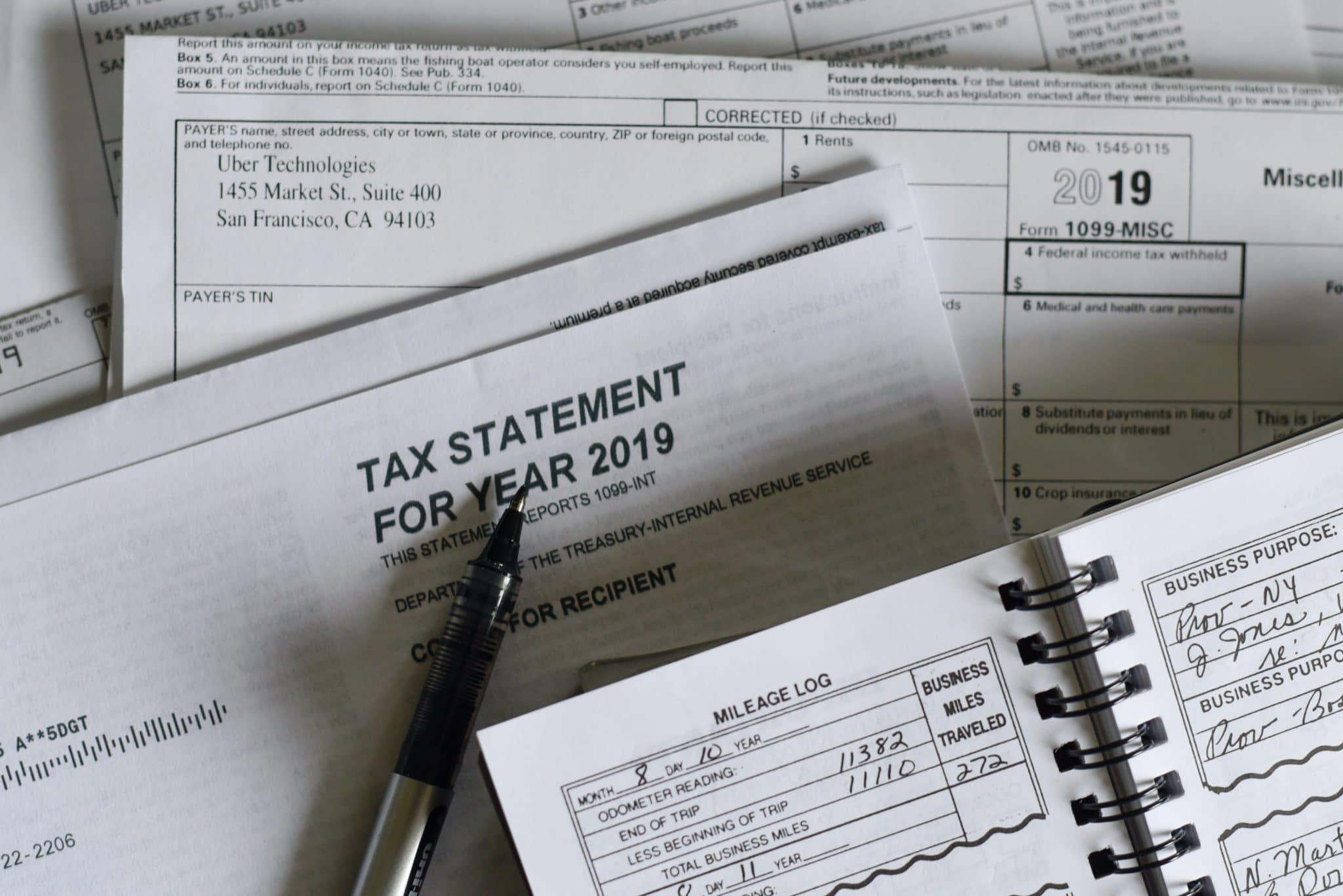

In a notice dated the 25th of March, 2014, the IRS outlines it stand, stating that virtual currency is property, for purposes of taxation. The notice 2014-21 mentions that cryptocurrencies are used as an alternative for real currencies and that the sale, exchange, and use of virtual money to pay for goods and services has tax implications. Taxpayers are advised to apply general principles that apply to property transactions, to enable them to pay taxes for virtual currencies.

Currently, wallets and exchanges are not set up to determine which coins should be sold or exchanged, which probably means that the IRS may have to default on the First-in-First-Out (FIFO) treatment. Specific identification would allow taxpayers to manage both short-term and long-term capital gains. For now, they have to pick out their methodology, as long as they maintain consistency throughout the return.

Virtual currency traders can minimize their taxes by holding off for more than a year. Short-term capital gains are taxed at the standard income rate, but long-term gains enjoy reduced taxes.

2. Capital Gains

Capital gains and losses are determined by how much the cost basis has gone up or down from the time of acquiring the cryptocurrency until there is a taxable event. The basis is the cost paid for the cryptocurrencies. The cost basis is subject to alterations through a subsequent purchase or a reinvestment.

3. Taxable Event

A taxable event is created during the sale or disposition of a cryptocurrency. The trade of a cryptocurrency can create gains or losses, therefore making it taxable. Also exchange of one token for another, e.g., Using Bitcoin to purchase an altcoin.

Receiving cryptocurrencies either as a salary, or payment for goods and services, spending a cryptocurrency, or converting it into US dollars are taxable events. Other events are mining, and Initial coin offerings since they are not in IRS’s list of tax-free treatments of raising capital.

4. Holding Period

A holding period is a time between acquisition of the cryptocurrency and the taxable event. If a taxpayer holds a cryptocurrency for more than one year, before the taxable event, its considered a long-term gain or loss. Any period shorter than a year is considered a short-term gain or loss.

5. Realized Gains and Losses

The volatility of cryptocurrencies has created confusion as to what pertains loss and gain. For tax purposes, losses and gains can only be realized if the asset is either sold or disposed of. There as to be a taxable event for taxation to occur.

For example, if a taxpayer bought bitcoins worth $1000, and decides to hold onto them when the value shoots to $25,000, then there is no gain. Similarly, no loss is realized when the value dives to $500. However, if the taxpayer should then sell the bitcoins at $750, then a loss of $250 is realized.

Any reports of losses and gains should be made on a Schedule D and then transferred to a reconciliation page on the federal form 1040. However, if no sale or disposition occurs, then there’s no need to file taxes.

What to Remember

The secret for great investors, such as Saleh Stevens, is to have access to first-hand information. This includes information concerning taxation. With the IRS hunting down tax evaders, it is important to be compliant. As a cryptocurrency trader, it is easier to keep a personal record, or spreadsheet of all virtual currencies, their costs, gains, losses, and transactions to ease the process when filing taxes. While the rules still need some polishing, avoiding taxation is only a postponement of the problem.

0 Comments